Facing a Slowdown

- Published: December 31, 2005, By Robert W. Marsh, Contributing Editor

Economic Outlook

Since the US economy has been shocked by the vicious attacks of 9/11, battered by three hurricanes, and pummeled by the increase in the cost of crude oil. Each time, the US economy staggered, righted itself, and kept on going.

“The natural tendency of the US economy is to expand,” says Robert Christian, executive VP and chief economist of Wilmington Trust Co. (see biography). “Since 1919, the economy has expanded in 64 percent of the months. That’s 1,046 months, and the economy expanded in 674 of these months, as measured by industrial production. That’s through depressions, recessions, oil price increases, wars, attacks on our soil, etc.

“Now, as the nation begins 2006, the economy is facing a slowdown,” he says. “Last year’s increase in interest rates alone is enough to cause a slowdown in economic activity. On top of that, when you add the very large increase in energy prices, that exacerbates the situation.

“Rising interest rates are taking money out of consumers’ pockets. Of all the homes sold in the past two years, approximately 30 percent of them have variable rate mortgages. Those mortgage rates are being re-set right now—and probably will be all the way through the year—at much higher levels of interest. That means those homeowners have to spend more of their take-home pay servicing their mortgages.”

Inasmuch as consumer spending and residential construction account for almost 80% of economic growth, the outlook for continued growth is not bright.

As Christian says, “Housing affordability is at the lowest level in 15 years because housing prices are up, interest rates are up, and consumer income has not kept pace, which means housing sales and starts are likely to falter throughout this year.”

What About Inflation?

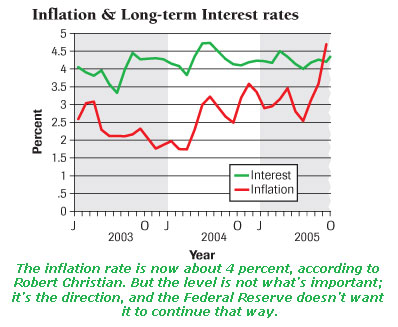

“The inflation rate a year and a half ago was under 2 percent,” Christian says. “It is now above 4 percent. But the level is not what’s important; it’s the direction. The Federal Reserve wants to make sure that inflation doesn’t go in the wrong direction and may raise interest rates in order to slow down inflation, which of course, slows down economic growth.”

Christian expects consumer spending to be sluggish in the first half of the year and that interest rates may peak at that point and then probably drift downward—together with inflation—in the final quarters of the year.

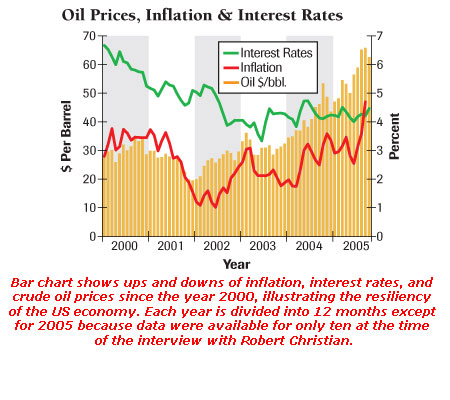

“Katrina and Rita had very little to do with the rise in inflation,” Christian says. “Roundly speaking, crude oil cost about 44 dollars per barrel at the beginning of 2005. By August—before the hurricanes—the price was 65 dollars per barrel, mostly due to the growth of the world economy. Come the hurricanes, you had a spike up to 70 dollars, but prices declined to 62 dollars as of early November last year.

“The increases in crude oil prices probably began in early 2004, precipitated by the expansion of the US economy and the international economy. In 2002, for example, typical growth in the US economy was about 2 percent. Come late 2003, early 2004, we had 4 percent and 5 percent growth. On top of that, add nearly 10 percent growth in China, plus the rest of the industrialized world, and we have had inflation for the past 18 months.

“If you look at Gross Domestic Product, economic growth in 2005 was around 3 percent, largely driven by consumer spending and residential construction. Both of those are likely to get weaker as we go through 2006. We are probably looking at a slowdown in economic growth by at least one percentage point. So, the economy probably will grow this year about 2.6 percent.

“With that slowdown will come a slowdown in the inflation rate. Inflation from December 2004 to December 2005 was probably 4 percent to 5 percent. That compares with 3 percent inflation in 2004 and 2 percent the year before that. However, with the slowdown in the economy this year, and the rise in interest rates already engineered by the Federal Reserve, inflation probably should peak at around 4.5 percent and then decline to 3 or 4 percent by the end of the year.”

China on the Move

“The Chinese economy has been growing steadily at about 7 percent to 9 percent,” says Christian. “This means they are demanding great quantities of steel, cars, and the gas to run them, concrete, aggregate to build roads, and other industrial commodities. So, industrial commodity prices probably are going to stay very strong. Maybe crude oil won’t go up to 100 dollars per barrel, but it’s also not going to head down to 40 dollars per barrel. I think energy prices are permanently high, and probably over time they will rise higher.”

Wal-Mart and the Future of Packaging

Converters better pay attention to what their customers are doing, says Colin McLellend, VP, Ernst and Young, Corporate Finance (Canada) (see biography), for that’s where the future lies. Take Wal-Mart, for example.

“What Wal-Mart does is on everybody’s radar screen,” McLelland says. “They have recently introduced an initiative to make packaging ‘green.’ Wal-Mart is arguably one of the largest users of packaging in the world, and when they say, ‘If you have a product that costs more but is better for the environment, don’t be afraid to show it to us,’ converters better listen.”

McLellend believes “there is a long-term trend toward making packaging ‘greener,’ recyclable, and biodegradable. I don’t think this will happen next week, but certainly suppliers of flexible packaging must think about how that might impact them in the future.”

The trend toward greener packaging is only one of several facing converters. McLellend cites the trend to globalization as another one. “The trend to global business has been moving more quickly in the last three or four years with the rise of China and the likes of Wal-Mart, Sears, and Kmart getting increasingly big and sourcing more and more of their products from outside North America. “Packaging, by and large, needs to be supplied locally,” McLellend says, “so to the extent that a converter’s customer’s production facility is offshore, the related packaging that goes with it will, in all likelihood, go offshore as well. The real changes in the levels of volume that North American packaging suppliers experiences have as much to do with where their customers decide to manufacture the product as with the general growth in the economy.

“This is not to say that local firms operating in a niche market are not going to survive,” McLellend points out, “but there is sort of a drop-off point when such a converter needs to decide whether to become big or remain in his niche and serve his customers very well.

“As the volumes increase and the sector grows in which the niche player operates, his products will become commoditized, and the only way the niche player can reinvent himself is to provide a packaging innovation.”

To McLelland, the future for packaging converters is very good. “Eighty or 90 percent of the packaging materials produced by converters ends up on a consumer product, although there is quite a strong industrial packaging market, too. By and large, packaging companies are insulated from economic movement because most packaged products are consumable—something you eat and something you use every day.

“Package converting is an increasingly competitive business, and converters need to make sure they are on top of their game and really have a good strategy that will take them where they want to be.”

The future of the US economy, including packaging, belongs to those who adapt to adversity and their customers’ needs.

Robert J. Christian, executive VP and chief economist, is a senior member of Wilmington Trust’s Investment Strategy Team and is responsible for economic forecasting and financial market analysis. He has more than three decades of experience in the financial and investment industries and is a graduate of LaSalle Univ. with a bachelor’s degree in economics. He earned his master’s in economics from the Univ. of Delaware.

As a VP with Ernst & Young Corporate Finance (Canada), Colin McLelland is a member of the E&Y global packaging and plastics industry team, focusing on providing transaction advisory services relating to mergers and acquisitions. Prior to joining E&Y as a senior associate in 1999, he was an associate with Crosbie Houlihan Lokey, a Canadian-based mid-market specialty investment banking firm. He holds a bachelor of business administration from Wilfrid Laurier Univ., is a chartered accountant, chartered business valuator, and a CFA charter holder.

Robert W. Marsh, former executive director of the Assn. of Industrial Metallizers, Coaters & Laminators (AIMCAL), is a retired marketing communications manager for ICI Americas, where he managed advertising, sales promotion, and product publicity for Melinex polyester films. Prior to joining ICI, he handled a variety of advertising assignments for the DuPont Co.