A Brighter Picture

- Published: December 31, 2003, By Robert W. Marsh, Contributing Editor

Gloomy reports notwithstanding, the US economy really is recovering.

With their focus on the loss of nearly three million jobs, the rising budget deficit, and the shift in production from the US to foreign countries, television anchors and newspaper articles paint a gloomy picture of the US economy.

But when Robert Fry, DuPont's senior associate economist, looks at a broader portfolio of economic indicators, he sees a brighter picture and described it in a mid-October interview. “Officially [i.e., according to the National Bureau of Economic Research], the US economy has been recovering from the 2001 recession since the fourth quarter of 2001,” he says, “and GDP has grown continuously since then. However, until recently, the recovery has been disappointingly slow — too slow to generate any growth in employment. But growth began to accelerate in the second quarter of 2003. Real gross domestic product (GDP) — the output of goods and services produced in the US — increased at just a 1.4 percent annual rate in the first quarter of 2003, but then rose at a 3.3 percent rate in the second quarter and at an 8.2 percent rate — the best since 1999 — in the third quarter.”

Seasonally Adjusted Data

But, business managers say, if the economy is growing so well, why don't we see much of an improvement in our own numbers?

“Unlike economists, who look at month-to-month changes in seasonally adjusted data,” Fry explains, “most businesses compare the figures of a given month or quarter to the same period of the previous year. On average, the year-over-year change won't turn up until five or six months after an economic turning point has occurred.” Fry uses about a dozen leading indicators to see where the US economy is headed.

Among Fry's preferred leading indicators are:

-

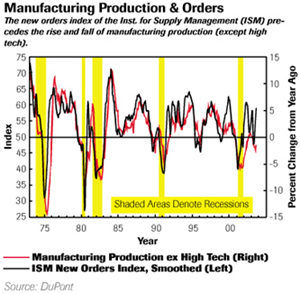

The Institute for Supply Management's new orders index — which rose above 60 in September of last year, ten points above the neutral level of 50, and the highest reading since December 2002.

-

Money supply — The M2 measure of the money supply (currency, checking accounts, savings, small time-deposits, overnight repurchase agreements at commercial banks, and non-institutional money markets), adjusted for inflation.

-

Interest rates — both the change in short-term rates and the relationship between short- and long-term rates. When short-term rates rise above long-term rates, it usually signals an impending recession. As of now, short-term rates are much lower than long-term rates, which signals a strong economy ahead.

-

Stock prices — rising stock prices are a positive signal that indicate improving expectations of future corporate earnings.

-

Inventories — have been kept lean. As demand rises, it must be satisfied by new production.

Fry notes other positive signs of recovery. “Vehicle sales were extremely strong in August,” he said, “which followed a very good July. Home sales have been at record levels for the past few months, and housing starts have stayed very strong. Furthermore, payroll employment was up in September for the first time in a long time.”

Industrial Production

He added “industrial production in US manufacturing grew in September by 0.8 percent, the biggest increase since March 2000. The manufacturing sector significantly under-performed the rest of the economy over the last few years, in part because of the shift in production to Asia — especially China. Chinese industrial production was up 16.3 percent from prior year levels in September.

“If you look at the recession of 2001 from a total economy standpoint,” he says, “it tied for the mildest recession ever. If you look at it from a manufacturing standpoint, it was not a mild recession; it was a typical recession in terms of depth and was longer than normal in duration. It wasn't simply a cyclical downturn, it was a structural shift; the movement of production away from the US toward the developing economies of Asia. Nevertheless, our total economy is growing.”

The outlook for new jobs in the US is positive, according to Fry. “The increase in employment we saw in September was probably a turning point, and I think we are going to start producing more in the US. Inventories are lean, and demand is strong. I think we are going to see total payroll employment continue to rise somewhat, mostly in the service sector of the economy. Manufacturing jobs may edge up a little, too, but they won't re-gain the 2.5 to 3 million manufacturing jobs that have been lost in the last few years. We may see exports picking up a little, and capital spending might grow somewhat, too. All together, these factors would mean more jobs.

“Tax cuts have already helped the economy,” says Fry. “The income tax rate cuts enacted in the third quarter of 2003 have already begun to help, and so have the child tax credit rebates. One of the most noticeable results of these tax cuts was the impact they had on vehicle sales. They were very strong in July and August, which were two of the best months ever, thanks to the combination of tax cuts and automobile company incentives to buy.”

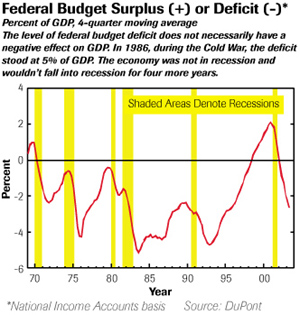

The federal deficit isn't hurting the economy, says Fry. “Short term, it has an expansionary effect. Some people are concerned about the deficit, [but] it will have to be much greater than it is now to have a serious negative impact on the economy. Even in fiscal 1986 — during the Cold War — the federal deficit was $221.2 billion; 5.0 percent of GDP. In fiscal 1992 the deficit was $290.4; 4.7 percent of GDP.”

Fry continues, “If the economy is basically at full employment and manufacturers are capacity-constrained and need to borrow money, a huge deficit could soak up the money available for financing and crowd them out. That could have a negative impact on the economy. But now, the country is so far short of full employment and capacity utilization is so low, I don't think we need to worry about the deficit.”

Fry concludes, “Keep your eye on the leading indicators. Although some sectors of the economy are down, leading indicators such as new orders, short-term interest rates, and inventories give a strong signal the US economy is really recovering.”

Robert W. Marsh , former executive director of the Association of Industrial Metallizers, Coaters, and Laminators (AIMCAL), is a retired marketing communications manager for ICI Americas, where he managed advertising, sales, promotion, and product publicity for Melinex polyester films. Prior to joining ICI, he handled a variety of advertising assignments for DuPont Co.

Robert C. Fry Jr. joined DuPont's Economists' Office in 1987 following a three-year stint in Conoco's Coordinating and Planning Department. As senior associate economist, he analyzes and forecasts global macroeconomics and its impact on DuPont. He assists DuPont businesses by interpreting economic data and using it to forecast DuPont performance. He is also the author of the monthly newsletter, “Current Business Developments.”

Fry received his B.S. in economics from Ohio Univ. and an M.S. as well as his Ph.D. in economics from Harvard. He is past president of the Board of Visitors of the Honors Tutorial College of Ohio Univ., a member of the Economic Roundtable of the Ohio Valley, and the National Assn. for Business Economics. He is a frequent speaker at trade association meetings and DuPont customer events.