Green Is Global

- Published: February 01, 2009, By By Corey M. Reardon, AWA Alexander Watson Assoc.

While functional excellence remains a given, buyers and converters of packaging and labeling materials are influenced strongly by other market drivers today. They include sustainability issues, in particular, and most recently, the global implications of the new European REACH chemical legislation. This legislation aims to identify, register, and ultimately control the use of hazardous chemicals — whether they are manufactured/sourced in Europe or imported there.

Today, innovation in paper, film, and foil converting is devoted primarily to meeting the needs of these new drivers in the context of the high profile packaging enjoys with brand manufacturers and with end-users. As the need to solve global sustainability issues increases, suppliers are required to answer a broad-based set of questions about the credentials of their raw materials, their manufacturing processes, their end products, and their corporate responsibility policies. As we all are aware, world-leading product manufacturers such as Procter & Gamble and Unilever, along with retailers such as Wal-Mart, are strongly influencing the future direction of the converting industry as a whole.

A Challenging Arena

This is a tough arena in which to operate — particularly when the continuing challenges of uncertain raw material costs, currency exchange rate problems, and competition at all levels of the value chain simply won't go away. Margin, plant utilization, and cost pressures continue to create the need for consolidation and rationalization.

The challenges presented in today's business environment also may impact attitudes toward sustainability — it is difficult for many companies to devote resources to sustainability when the actual fabric of the business itself is under threat from declining business volumes and margins.

In the face of climate change, using less energy and creating fewer volatile organic compound (VOC) emissions increasingly are part of the equation for converters. Petrochemicals feature in every element of the business, from transport and logistics to the manufacture of packaging and labeling films.

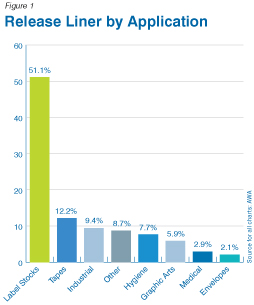

Platinum — the silicone catalyst for release liner for pressure-sensitive label stock and other products (see Figure 1) — is at global price highs, with demand exceeding supply globally and no viable alternative as yet on the horizon. There is also a world shortage of acrylics.

Even for papers and boards, the new emphasis on sustainability and forest stewardship certification (FSC and PEFC) is driving up the prices for pulp-based materials in “ethical” buying situations. However, only about 7% of the world's forests are certified, just one-third of all commercial forests, so price pressures will continue.

Growth in Films

Growth in film materials across all converting industries and all countries is much greater than in papers. One of the prime drivers for film's popularity is its lighter weight — a key attribute today.

The whole packaging industry is moving to lighter-weight containers and thinner label materials to save time and costs. For the converter, thinner materials for roll-fed lamination or conversion mean less roll changes, less downtime, less handling.

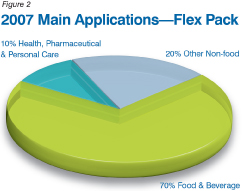

The cost of logistics and transportation also can be lower if the weight of the packaged products to be delivered is reduced. In this context, of course, flexible packaging — pouches, sachets, etc. — is making great strides. As shown in Figure 2, food and beverage is by far the leading application for flexible packaging.

Extrusion Coating

Interestingly in today's film-focused world, papers and boards still account for some 70% of all materials used in extrusion coating. The process greatly enhances performance.

Tetra Pak's gable-top carton packages have proved one of the most versatile solutions available and increasingly are used for dry and moist foods today — including sugar for pouring. The composite nature of their material makeup, however, has created problems in post-consumer waste recycling — an issue the company is addressing actively.

However, while papers and boards will continue to grow at a steady 1%/yr through 2010, we expect extrusion-coated films to grow faster at 2.5%.

For release liners backing p-s labels, films offer the best solution for “no-label-look” applications because of their smooth adhesive wet-out characteristics. We are seeing caliper reductions down to about 23 microns for polyethylene terephthalate (PET) liners.

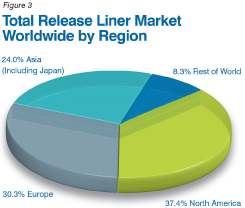

Liner recycling now is gaining impetus as awareness is growing of the opportunities of waste and scrap sorting for different recycling techniques, both in waste management companies and in the converting industries. Film liner is a valuable and versatile material for recycling. Worldwide demand for release liner is detailed in Figure 3.

For the p-s laminators and their suppliers, the current requirements of the broader packaging market are echoed in the need for even greater versatility and innovation. The trend to lower-gauge facestocks for a better cost/performance ratio is evident not only in films but also in papers that can include print-friendly top coatings to enable the successful use of lower grades and calipers.

Vacuum Coating

More than 400 companies are actively involved in the vacuum coating of papers, films, and board materials today. We forecast global production will increase at an annualized rate of 5%-5.5% to 2012, the majority in vacuum-coated film products.

Packaging is the largest end-use market segment, with about 69% of materials usage. Here the main drivers today are the need for improvements in barrier performance for clear and opaque vacuum-coated films and for the high-impact aesthetics achievable with metallized films.

Growth prospects in the NAFTA region (28% of global vacuum-coated material volumes) and Europe (33%) have slowed. Today the major geographic focus is the Asia-Pacific region, where growth is strongest in both production and usage.

Metallized Films & Papers

The dynamic development of flexible packaging in all its forms has led to a resurgence of interest in metallized papers and films as barrier materials and has encouraged significant technology advances to the benefit of the packaging and labeling industry in general. The market for metallized materials is, indeed, dominated by flexible packaging applications.

Metallized film is the most popular medium, with polypropylene (PP) and PET taking 55% and 38% of the market respectively — for applications in clear oxide and other opaque barrier coatings for flexible packaging; pattern or stripe metallizing; and the whole raft of security and brand authentication holography.

Metallized papers find their way primarily into the labeling market. As research continues to show consumers favor a metallic sparkle on packaging, leading brands — particularly beers — represent buoyant business for metallized paper labels.

While there is real evidence of activity in metallized materials, competition from alternative barrier coatings and container formats is increasing in the packaging market. There is a lack of development in metallized papers outside the areas of labels and cigarette inner liner. However, for the short and medium term, the outlook for the metallizing market is positive, particularly for films, as flexible packaging opens up more opportunities for metallized barrier coatings.

Label Materials

Looking specifically at the label technologies, the actions and initiatives in the wider world of papers and films have, of course, migrated into label printing substrates and, for p-s labels, into release liners. While paper remains the prime label substrate choice, film substrates are growing faster all-round — in the glue-applied wraparound, p-s, and sleeve label markets.

The main trend is to down-gauged films. “Thin” films, particularly for roll-to-roll converting, benefit from delivering more labels per roll and save time and cost, both on-press and in automatic dispensing. Manufacturers are working to reduce caliper without impairing conversion characteristics. There are plenty of printable films at just 50 microns available today.

For glue-applied labels, the demand for film-based wraparound labels is the main driver for growth, and this is particularly evident in the beverage sector for soft drinks. Despite the fall-off in demand for carbonated soft drinks in North America and Europe, overall global demand has been driven by the growth in mineral waters.

Taking all soft drinks together, Zenith reports the greatest growth in 2007 came from the developing Eastern European market, achieving a 9.8% increase. Elsewhere, Africa grew by 7.1%, Asia-Pacific by 6.9%, the Middle East by 6.6%, and Latin America by 4.3%.

In the two mature markets of North America and Western Europe, North America enjoyed slightly greater growth of 1.1%, compared to 0.1% for Western Europe. Much of this growth is packaged in the ubiquitous PET bottle, labeled with a glue-applied film wraparound label.

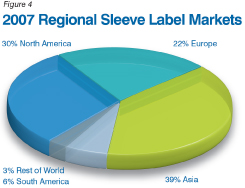

Sleeve labels have enjoyed the highest growth rate of all label types on a regional and global level. The market for sleeves by region is shown in Figure 4.

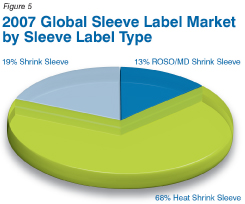

This film-based label format is forecast to continue to grow at double-digit level, but as for all label formats, it is showing signs of a slowdown in annual rates as market penetration levels are realized. Figure 5 details the global market for sleeves by type.

Bio-Films

We should not forget the recent innovation: bio-films. Biodegradable and compostable wood pulp-based films and maize-based, annually renewable films (PLA) initially were much heralded but still represent just 2%-3% of film use in the label market, where the most inroads have been made. Growth has stalled.

Cultivating maize to make PLA films, as well as nonpetroleum-based bio-fuels — originally viewed as an opportunity for arable farmers across the globe — is now the subject of negative consumer sentiment. It is compromising food crop cultivation, and the environmental credentials of bio-films additionally have been put in question by recent reports of recyclability problems.

P-S Adhesives

Adhesive formulations in p-s label laminates now favor emulsions and hot melts. The new-generation ultraviolet hot melts claim to approach the adhesion values of solvent-based adhesives, which historically were preferred for high-performance applications but today are at the center of environmental concern.

Simplifying the adhesive inventory a converter needs to offer is a challenge for manufacturers, but it could represent significant cost savings in label complexity and stock holding. The narrow web converting industry also is experiencing a move toward in-line and off-line adhesive coating of substrates as an alternative to purchasing label stock from the laminate suppliers.

Label Market Profile

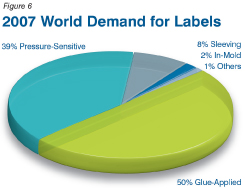

In the broad field of product decoration, traditional glue-applied labels (including the glue-applied wraparound sleeves that predominate on PET bottles) still dominate globally (see Figure 6, p26). The p-s label continues to offer high-end solutions, particularly when added-value functionality is required (the no-label look, RFID, overt and covert security features, package reclosures, leaflet labels, etc.).

Together, these two technologies represent around 90% of the world's labeling needs. However, cartons, cans, and glass containers decorated with traditional labels now compete with shrink sleeves, in-mold labeled plastic tubs, and most importantly, with molded and extruded pouches, sachets, tubes, and other flexible packaging media.

Practical Actions

Advancing the technologies of coating, lamination, and metallizing now is centered on two major areas of focus: the environment and cost control. In the sustainability arena, the entire supply chain — including converters — has identified many areas where sustainability principles and effective environmental management practices can be applied in their day-to-day businesses to the benefit not only of a reduced carbon footprint but also of improved profitability and cost control.

Such initiatives include operating to established international and regional safety and environmental standards; employing industrial waste management principles and systems; reducing the energy used in production processes; and driving down production losses and scrap. In coating, converting, and metallizing, suppliers at all levels of the chain understand it makes sense to deal with such housekeeping issues while driving forward technological excellence at a time when we are suffering from availability and price pressures on the world's natural resources, a global economic downturn, and the need to maintain profitability and satisfy an ever-more-demanding customer base.

Corey M. Reardon is president and CEO of AWA Alexander Watson Assoc., Amsterdam, Netherlands, a market research firm that specializes in monitoring the coating, laminating, metallizing, label, and packaging markets around the globe. The company publishes regular in-depth market reports as well as organizes related industry conferences, seminars, and other events. For more information visit www.awa-bv.com.

Want To Know More?

Find additional information on the market for extrusion-coated products at PFFC's Coat/Laminating area. .