AMI Issues Study of High Barrier Films

- Published: October 05, 2016

BRISTOL, UK | Applied Market Information (AMI) announces a new consulting data report entitled High Barrier Flexible Films for Food Packaging.

AMI says food packaging represents one of the largest and most important global markets for plastic films, and developing films with sufficient barrier properties to protect, preserve, and extend shelf life of the packed product is a growing requirement of the food industry and retail supply chain. As the world becomes ever more aware of the waste of perishable food supplies, the plastics industry must accordingly develop and seek out new advancements in technology to meet new needs and the increasing moral obligations of policy makers.

The company notes that plastic substrates offer many benefits to brand owners in terms of lightweight, strength, clarity, flexibility, and printability but are often much poorer in terms of the permeation of gases, aromas, and flavors. Developing sufficient barrier at an appropriate cost is complex and challenging, says AMI, and many solutions have been developed that vary according to product, geography, and the nature of the converting industry.

The outlook for high barrier films for food packaging looks set for robust growth, the report says, exceeding the general trends for food packaging and GDP. Global demand for food packaging films was estimated to have reached nearly 17 million tonnes in 2015, of which 1.4 million tonnes incorporated a high barrier, as defined as a film with an oxygen permeability of less than 10 cc. Although high barrier films represent only 8% of the total flexible food packaging market, in value terms the share is considerably higher.

The report seeks to provide an in-depth analysis of the current solutions available to the market along with the trends driving the use of particular substrates and barrier methods. Future growth in the market is forecast to 2020. The study relates to flexible films of less than 50 micron with barrier providing an oxygen transmission rate (OTR) of less than 10 cc/m2/24 hrs.

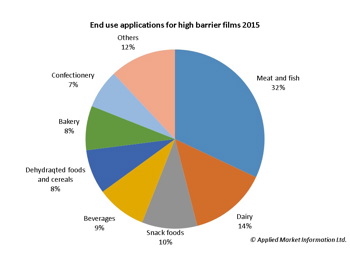

Also included is a review of the industry structure and the position of the leading players within the supply chain both globally and within each region, giving an assessment of the demand for high barrier films by substrate (i.e. BOPET, BOPP, PE, polyamide, etc.) and by barrier method (metallization, coating, coex, etc.), along with trends and demand for high barrier films by key end use segments (meat and fish, snack foods, dairy, bakery etc.).

When considering global market demand, meat and fish account for 32% and together form the largest end-use application, with other end-use applications taking similar portions of demand of approximately 10% each. On a regional basis these figures differ more dramatically, emphasizing the social and economic tendencies of individual regions.

The study provides users with a detailed independent assessment of the global market for high barrier films for food packaging, looking at both past trends and developments and giving a five-year forecast to assist companies with their business planning and decision-making with regard to future investments. It also provides a global assessment as well as an in-depth regional analysis.

This email address is being protected from spambots. You need JavaScript enabled to view it.