Made of Money

- Published: January 01, 2007, By Bill Hornell, Mesirow Financial

Mergers & Acquisitions

The packaging industry currently is experiencing a wave of private equity-driven merger and acquisition transactions. This activity is being fueled by an enormous stockpile of cash that needs to be invested by the private equity groups that have raised this money. The net result is that valuations in the packaging marketplace have increased significantly and significant new private equity-backed competitors are being created.

Private Equity Industry

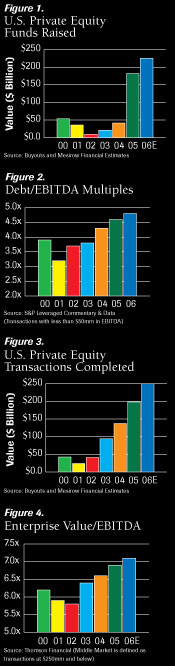

As demonstrated in Figure 1, the private equity industry recently has experienced a tremendous increase in fundraising activity.

This boom has been driven by institutional investors such as pension plans, endowments, and insurance companies having unprecedented levels of funds to invest. Seeking alternatives to traditional equity and fixed income investments, these institutional investors have been pouring money into private equity.

Leverage Boosts Purchasing Power

Private equity groups have the ability to borrow money and leverage the purchasing power of their equity. Figure 2 demonstrates how aggressively private equity groups have been able to leverage their purchasing power through borrowing.

These borrowed funds are provided by banks, insurance companies, and specialized aggressive lenders known as mezzanine funds.

Level of Transactions and Impact on Valuations

The combination of available private equity and increased leverage capability has resulted in significant purchasing power for private equity groups. Figure 3 demonstrates the increased level of private equity deals in the general merger and acquisition marketplace.

As private equity groups compete with strategic acquirers to buy businesses, valuations for the target companies increase. Figure 4 demonstrates how purchase prices for middle-market businesses as a multiple of EBITDA (earnings before interest, taxes, depreciation, and amortization) have increased.

Effect on Competition

While most industries have been affected by this private equity boom, packaging seems to be receiving a disproportionate level of interest from private equity buyers (see sidebar below). Most of the recent private equity activity in packaging has been focused on the consumer side of the business (flexible packaging, labels, folding cartons). Generally, it is believed consumer packaging is less cyclical than industrial packaging and consequently better suited for the borrowing leverage that’s utilized in a private equity transaction.

It will be interesting to see how the infusion of private equity into packaging will play out. Look at what’s happened with Texas Pacific Group’s acquisition of Smurfit-Stone’s consumer packaging business (renamed Altivity). That transaction closed in July 2006. Within two months, Altivity had acquired Field Container Corp., another leading folding carton manufacturer. Undoubtedly, there will be significant opportunities for cost savings and facilities rationalization created by these two acquisitions.

Transactions like these ultimately could lead to a reduction of the excess converting capacity that exists in the folding carton industry. Hopefully that will lead to better operating margins for converters.

A similar situation is playing out in the flexible packaging industry. In 2005, within the course of six months, Sun Capital built one of the largest flexible packaging companies in North America by purchasing Cello-Foil, The Packaging Group, and Exopack. Developing this type of platform seems to allow for better utilization of physical resources and provide for economies of scale in marketing, product development, and purchasing.

Exit Strategies

Today’s private equity investors believe there will be several attractive exit strategies for their packaging investments. Almost every major segment of packaging has participants that are publicly held and are looking to grow through acquisitions. These publicly held companies are likely acquirers when private equity owners look to sell their packaging investments.

Also, it is not uncommon for a private equity group to sell an investment to another private equity group (WS Packaging and Ampac are two recent examples). I also would not be surprised to see some of these larger private equity packaging platforms go public. The critical factor will be growth. If a growth record can be established, some will go public.

Outlook

The infusion of private equity into packaging will continue. The private equity asset class has become standard operating procedure for most institutional investors. As long as institutional assets continue to grow, private equity will continue to change the packaging landscape.

Interest in Packaging

This list demonstrates some of the recent private equity-backed transactions in packaging: Texas Pacific Group’s purchase of Smurfit-Stone’s Consumer Packaging business (renamed Altivity) <$1.04B>

Altivity’s acquisition of Field Container Corp. <Undisclosed>

JW Child’s purchase of WS Packaging <Undisclosed>

Prudential Capital’s acquisition of Ampac <Undisclosed>

Apollo Group’s acquisition of International Paper’s Coated Papers business <$1.399B>

Apollo Group’s acquisition of Berry Plastics <$2.288B>

Milestone Partners acquisition of Outlook Group <$55.2M>

*Disclosed amounts provided by Capital IQ.

Bill Hornell is a managing director in the Investment Banking Group at Mesirow Financial. He has completed more than 60 merger and acquisition packaging transactions. A significant majority of these transactions involved consumer packaging businesses. Reach him at 312/595-6176; bhornell@mesirowfinancial.com;