Why the Rush to BOPA?

- Published: March 31, 2005, By Simon King, PCI Films Consulting

BOPA Film

In the past five years, the world bi-oriented polyamide (BOPA) film market has grown faster than any other oriented speciality film, but volumes still are small when compared to its leading competitors—bi-oriented polypropylene (BOPP) and bi-oriented polyester (BOPET) film. With average growth rates of 8%/yr, world BOPA film demand is expected to reach an estimated 126,000 tonnes in 2004, compared to world markets for packaging grades of BOPP film of 2.5 million tonnes and BOPET film of 600,000 tonnes.

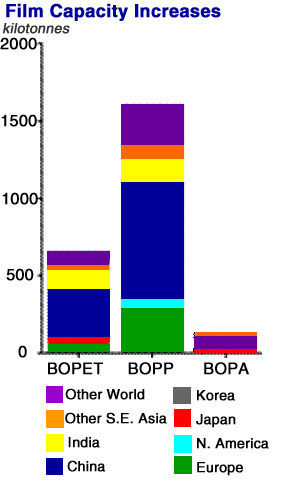

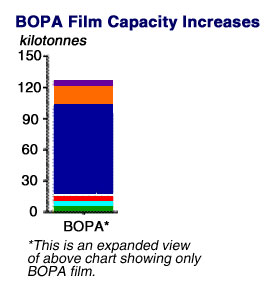

Even the forecast expansion of BOPA film production is small compared to the planned expansion of the industries of its major competitors. Between 2003 and 2008, the world BOPET film industry will expand by 650,000 tonnes (36%); the BOPP film industry by 1,600,000 tonnes (48%); and the BOPA film industry by a mere 126,000 tonnes—but this will nonetheless double its size.

We expect all three oriented film industries to experience the same problems of over-capacity to some degree over the next five years. This is because demand is not growing fast enough to catch up with available and new capacity.

In researching the BOPA film sector, we were unable to identify any significant structural change to world demand that will cause growth rates to accelerate and therefore warrant the 26 additional extrusion lines planned. At best we forecast world BOPA film demand growing at a slightly higher rate of 10%/yr over the next five years. At its most optimistic, this represents an additional 2–3 lines/yr from the balanced position the market is in today (with an average line capacity of 4,000–5,000 tonnes/yr).

So in PCI’s view, meeting future demand growth does not warrant a doubling in size of the BOPA film industry. We do accept additional capacity will be required, but why so many announcements in such a short time?

Off-the-Shelf Technology

The answer appears to be very simple. In the past, the small number of existing BOPA film producers controlled supplies through patented and licensed technology and met demand increases with a new production line every other year or so. But with the development of off-the-shelf extrusion technology from the likes of DMT, Brueckner, and MHI, an investment now could be made by anybody, and this appears to be exactly what has happened. Everyone has seen the tightening in the market, and everyone has said it is time to invest!

The vast majority of this new capacity is planned for China, and in the next three years, 13 new companies will commence production of BOPA film there, achieving a capacity of 98,000 tonnes by 2008—four being new plants for existing Japanese producers. With domestic demand growing at 20%/yr from 20,000 tonnes in 2004, it is clear questions will need to be answered in the coming years:

- Will all this announced capacity in China actually be installed?

- Will it all run efficiently?

- Will Chinese producers export volume to fill capacity?

- What will happen to world BOPA film prices if they do?

Undoubtedly, the world BOPA film industry is set for major structural change as competition intensifies and overcapacity forces tough decisions to be made. The best this industry can hope for is better planning of future installations (delays?) and new investments and for demand to be stimulated by the large number of new producers chasing business.

Simon King is managing director of market intelligence firm PCI Films Consulting in Oxon, UK. PCI’s study, "World BOPA Trends 2004," provides world and regional supply and demand statistics and analysis, regional price and end-use data, technical film characteristics tables, and manufacturer/converter profiles. The study is based on new and original field research with resin suppliers, machinery manufacturers, BOPA film manufacturers, film distributors and agents, and flexible packaging converters. For more information visit pcifilms.com or email: s.king@pcifilms.com.