Coating & Laminating Special Report, Part 2

- Published: December 31, 2004, By Robert Marsh, Contributing Editor

Part 1 | Part 2 | Part 3 | Part 4 | Part 5 | Part 6

A Bright Future (cont.)

Boats and Growth

Steve Sedlak at ESK Ceramics has a positive outlook for his evaporation boat business. He’s the sales manager for metallizing in North America and sees growth in his territory matching that of America’s GDP. "Worldwide, we expect more than double digit growth," he says.

ESK was formerly Wacker Ceramics, a division of Wacker-Chemie GmbH. It became a Ceradyne company last summer, according to Sedlak. ESK Ceramics’ headquarters remains in Kempten, Germany, with the US office in Saline, MI. Ceradyne Inc. is a specialty ceramics company based in Costa Mesa, CA.

"A lot of the demand for our boats," Sedlak says, "revolves around flexible barrier packaging. There is a huge demand. But there are always pressures to become more efficient and more competitive. Metallizers are wider and faster than ever and evaporation rates need to keep pace. So, we work continuously to improve the performance of our boats.

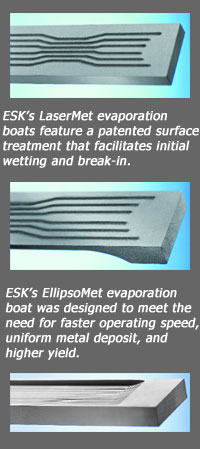

"In recent years," Sedlak says, "ESK developments have included commercialization of our EllipsoMet and LaserMet evaporation boats. These include a patented surface treatment that facilitates the initial wetting and break-in. The surface treatment allows for higher evaporation rates and easier operator control. Tangible results have included reaching operating speed faster, achieving more uniform metal deposit, and higher yield of first quality metallized material. ESK works directly with customers to maximize their metallizing efficiencies."

Sedlak looks to Asia for an increase in total sales of evaporative boats because "most of the new machines are going there and we are involved in them. So the long-term outlook we see is very positive."

A Wider Outlook

A broader view of the metallizing industry comes from Craig Sheppard, executive director of the Assn. of Industrial Metallizers, Coaters & Laminators (AIMCAL). In Sheppard’s view, "Metallized films and papers have proven themselves as the material of choice where barrier and aesthetics are key factors. Metallized substrates will continue to gain share in these areas due to their high performance and economics.

"The greatest challenge facing metallizing companies is strengthening their position in the supply chain. Large raw material suppliers are increasing the cost of materials used in producing metallized films and papers and large end-users are exerting price pressures on the finished products. The ability of the metallizers to address these issues will be the key to their long term growth and prosperity."

A global view of metallizing comes from Paolo Raugei, executive VP of Galileo Systems. Paolo says, "As for the outlook of the US metallized packaging market, local producers are going to face more and more pressure from overseas. There is still a high level of new capital equipment investment in the Asian emerging countries and all that new production cannot be absorbed by their internal markets only. Therefore, they must find export opportunities and the US is a prime target, even with the weak dollar. Some of these countries maintain an artificial peg to the dollar; therefore, the currency issue is not really a question for them. Therefore, US producers are facing state-of-the-art equipment, low-price raw materials, and cheap labor. Quite a recipe for success!

"As for Europe, we have seen a movement to geographic diversification by establishing new plants in low-cost countries that are also emerging markets. It is surprising though that it is not only the Europeans who take advantage of these opportunities, but also some of the same entrepreneurs who are active in Asia and elsewhere. It looks like they have a different outlook to international investing and global opportunities.

"In summary, I expect US producers to continue investing in new equipment technology to keep up with imports. Global investing will continue, and I expect that ‘new-wave’ entrepreneurs will establish new plants in strategic areas that will offer low cost and provide access to the US market."

CONVERTER INFO:

PROMA Technologies

24 Forge Pk.

Franklin, MA 02038

508/541-7700; holoprism.com

Vacumet Corp.

22 Riverview Dr., Ste. 101

Wayne, NJ 07470

973/628-0400; vacumet.com

SUPPLIER INFO:

Assn. of Industrial Metallizers, Coaters & Laminators—aimcal.org

AET Films—aetfilms.com

Applied Films Corp.—appliedfilms.com

ESK Ceramics—ceradyne.com

Galileo Vacuum Systems—galileovacuum.com

Lamart Corp. has been selected by NASA to develop a laminated envelope for the proposed Aerobot to be flown around Titan, a moon of the planet Saturn. According to Lee Smith, project manager, "Our ultimate objective will be to develop an extremely thin, exceptionally strong, and highly flexible material for the unmanned blimp." So far, Lamart has tested materials made up of as many as 11 layers of high performance films with a combined thickness of a little more than one mil." Adds Peter Mahr, Lamart technical consultant, "…the real challenge comes from the ultra-low temperature of the atmosphere of Titan. The material must be flexible at temperatures as low as—196 deg C. Therefore, a primary focus will be to identify films and adhesives that can function at these low temperatures."

The Aerobot will be delivered by rocket to Titan and piloted by computer on Earth. It will remain active for several months to conduct a relatively low altitude survey of Titan’s surface. The planet’s atmosphere is more dense than Earth’s, which permits the envelope to be filled with a light gas such as hydrogen. The vehicle will be about 10 meters long.

CONVERTER INFO:

Lamart Corp.

16 Richmond St.

Clifton, NJ 07015

973/772-6262; lamartcorp.com

Contributing editor Robert Marsh is former executive director of AIMCAL and a retired marketing communications manager for ICI Americas, where he managed advertising, sales promotion, and product publicity for Melinex polyester films. Prior to joining ICI, he handled advertising assignments for DuPont Co.

Part 1 | Part 2 | Part 3 | Part 4 | Part 5 | Part 6